11 July 2014

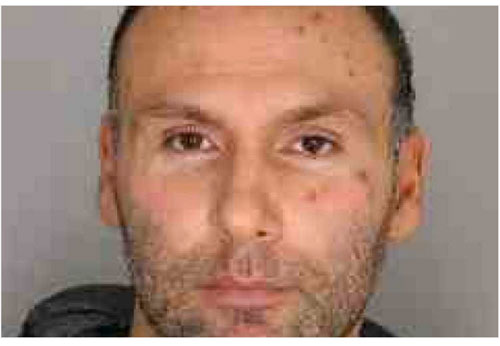

A former condominium association president was arrested Thursday and charged with allegedly embezzling about $22,500 in association funds to pay for a long-distance affair.

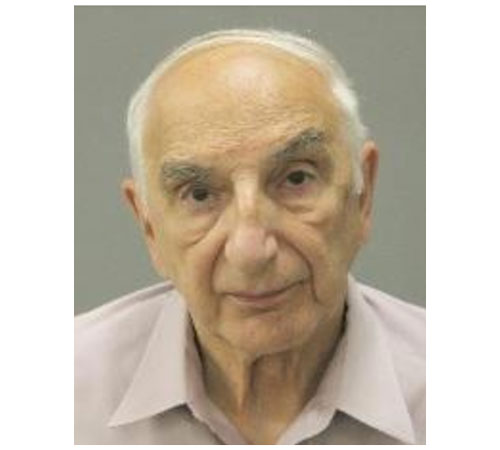

Representatives of the Norwich K Condominium Association reported former President and Treasurer Alan Kaplan, 82, of West Palm Beach, to police after an audit of the association’s bank accounts, according to the police report.