| Date |

Selling |

Bed |

Bath |

Fees |

Notes |

| Feb 14 |

$

85,000 |

3 |

2 |

N/A |

sold as-is |

| Feb 14 |

85,000 |

2 |

1 |

$

493.00 |

plus hydro |

| Apr 14 |

129,900 |

3 |

2 |

607.41 |

|

| May 14 |

165,000 |

2 |

1 |

466.72 |

|

| July 14 |

138,000 |

4 |

3 |

858.00 |

$3,000 a

month in

rent |

| July 14 | 149,000 |

4 |

3 |

1,236.46 |

2,240

square feet |

| July 14 | 142,500 |

3 |

2 |

607.41 |

$30,000

spent on

renovations |

| Aug 14 |

110,000 |

3 |

2 |

607.41 |

|

| The administrator dramatically raised the monthly fees |

|||||

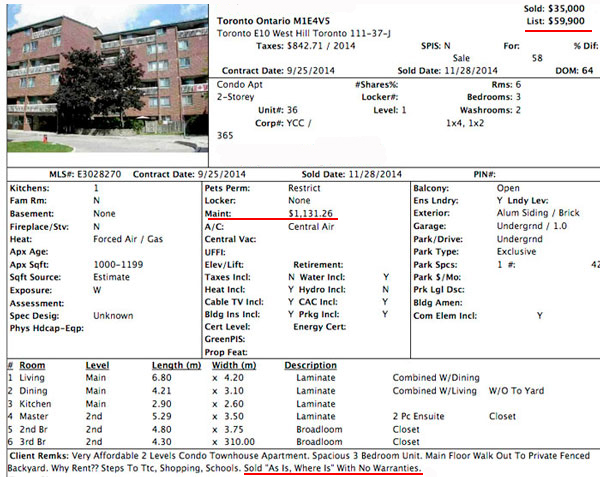

| Nov 14 |

$ 35,000 |

3 |

2 |

$ 1,131.26 |

Power

of Sale |

| Jan 15 |

55,000 |

2+1 |

2 |

1,131.26 |

|

| Mar 15 |

55,500 |

3 |

2 |

1,089.99 |

|

| Mar 15 |

45,000 |

3 |

2 |

1,131.26 |

|

| Aug 15 |

43,000 |

2 |

1 |

1,131.62 |

|

| Oct 15 |

85,000 |

2 |

1 |

837.62 |

|

| Oct 15 |

50,000 |

2 |

1 |

837.62 |

|

| Nov 15 |

58,000 |

3 |

2 |

1,089.99 |

|

| Feb 16 |

40,000 |

2 |

1 |

762.03 |

|

| Feb 16 |

48,000 |

2 |

1 |

914.43 |

|

| May 16 |

65,000 |

3 |

2 |

991.74 |

|