1.

|

The board gets a by-law passed allowing them to assume a loan for up to $5 million.

|

|

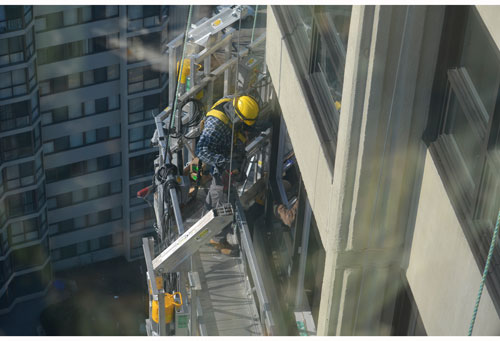

The board uses the $5 million "line of credit"to

pay off a $300,000 deficit, upgrade the lobby and hallways and repair

or replace everything needed from the fire panel to new windows, from

re-caulking the building envelop to repairing the leaks in the

underground garage. |

2.

|

The money that presently exists in the

Reserve Fund stays there to pay for any unexpected repairs and to make

the Status Certificates look good.

|

3.

|

Money from the monthly fees that would have gone into the Reserves to

pay for this work in installments is used to pay the loan's principal and

interest payments.

|

4.

|

Most of the monthly maintenance fees go into the Operating Fund to keep the lights on and the elevators running.

|

5.

|

To keep the loan payments

affordable with the monthly fees pegged to the rate of inflation, the

loans have been spread out over ten and twenty year amortization

periods. |