The risk of a Special Assessment

Is there a way of determining when a Special Assessment—or much worse a

loan—is on its way? Of course. you simply compare how much you have to

spend compared to how much you need to spend.

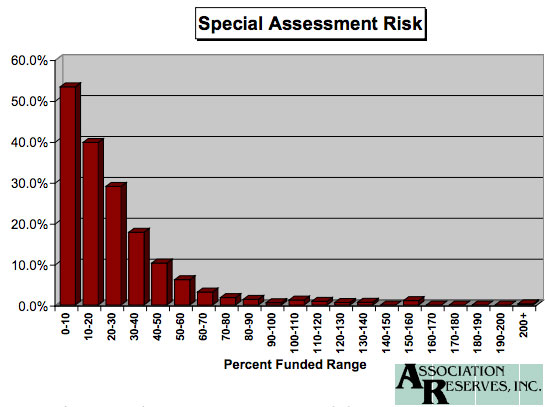

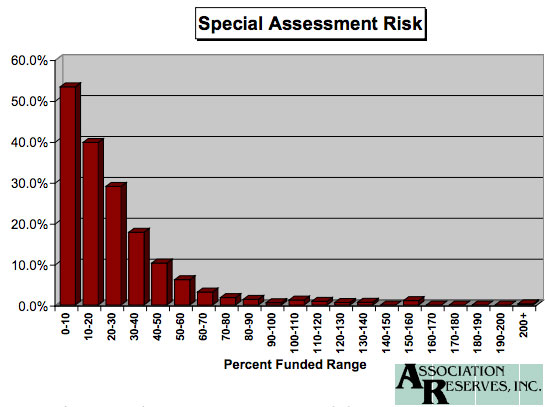

The above chart was published by Association Reserves Inc. a large

American engineering company that prepares Reserve Studies for

association-governed communities. It comes from a report:

Why Percent Funded Should Matter to You.

What they state is that if you divide the amount of money that your

corporation's Reserve Fund Study says you need to make necessary major

repairs and replacements by the actual amount you have in the Reserve

Fund to determine the health of your Reserve Fund as a percentage.

This is just common sense.

|

Condo

#1

|

Condo

#2

|

Condo

#3

|

Reserve Funds

|

$2,220,000

|

$2,220,000 |

$00013,000

|

RFS recommendations

|

1,800,000

|

4,300,000

|

2,000,000

|

Percentage funded

|

123%

|

52%

|

0.0065%

|

If you look at the examples above, there are two condos that have $2.2

million in the Reserves. Even though they both have the same amount in

the Reserves, one is adequately funded and the other is not.

So bragging about having a $2 million Reserve Fund, on its own, does

not mean much if your condo has been badly neglected or if an

unexpected disaster occurred.

The third example (Condo # 3) shows the actual figures for one condo in the west-end

of Toronto. They are going to need a lot money than they can get with a special

assessment because, when the building inspectors show up nothing less than a winning lottery ticket will save

them.

How good is this

chart?

The basic idea is sound but I personally think that this engineering

company underestimates the risk of a special assessment to pay for

major repairs and replacements when the percentage funded drops below

70% of the recommended amount.

top contents chapter previous

next