contents

chapter previous next

Excessive legal costs

“I believe that there is an obligation

on property managers to act wisely and prudently in their position of

trust, with respect to paying accounts, whether it be for the plumber,

the roofer and even the lawyers.”

—Deputy Judge M. Klein

Costs: The elephant in the courtroom

By Mario Gravel

In the Fall 2013 edition of Condo Law, Mario Gravel wrote that condominium corporations are not guaranteed full legal

costs when they win.

He cites two examples of where the judges did not allow full costs. It

is an important article that all condo boards should read.

Below, I cite far more examples, of the courts rolling back fees,

several which should have embarrassed the legal firms involved and many

that point out how the use of Section 134.(5) of the Condominium Act

appears to encourage aggressive legal costs being charged unit owners

when their condo corporation wins court orders.

Court cases

Dyke vs

MTCC No. 972

Ontario Superior Court

Court File No: CV-11-443081

Before: Justice E.M. Morgan

Heard: 30 January 2015

Ms. Dyke lost this motion which dealt with her complaints that her new

neighbour was making unnecessary noise.

What is very interesting is the judge's reasoning for awarded costs

that were far lower than what the condo's law firm billed the

corporation.

Justice Morgan wrote: (abridged)

"Mr. Rutherford, counsel for the condo corporation (The Century Plaza)

in the Application, has requested costs in the amount of just over

$66,000 on a partial indemnity basis and $97,000 on a substantial

indemnity basis. He concedes that

the amount is high for a one-day motion,

but counsel makes the point that the other condominium owners in the

building should not have to bear the brunt of the high cost of

defending this matter.

For her part, Ms. Dyke’s view is that the matter has been made more

complex and costly than necessary due to the way in which it was

defended. She also makes the point that a portion of the Costs Outline

served by Mr. Rutherford relates to a failed mediation, which is not

something that Ms. Dyke should have to bear. She

indicates that she was seeking to enforce in a bona fide way what she

viewed as her rights and that there is no reason to award costs on a

substantial indemnity basis. She also submits that she simply cannot

afford the level of costs sought by the condo corporation.

I feel considerable sympathy for Ms. Dyke. She has indicated that she

is in poor health and is not currently working, and that the problems

with the noise have caused her concern about the re-sale value of her

condominium. Moreover, she has suffered the stress and anxiety of

litigation during a difficult time in her life.

Overall, the court is required to

consider what is “fair and reasonable”

in fixing costs, and is to do so with a view to balancing compensation

of the successful party with the goal of fostering access to justice.

Given that a large portion of Mr. Rutherford’s Costs Outline relates to

either work that pre-dates the Applicant’s contempt motion or that was

associated with the unsuccessful mediation attempts, his request contains a substantial amount

of unrecoverable costs.

Further, while I take Mr. Rutherford’s point about sparing the innocent

condominium owners excessive legal fees, I am mindful of ongoing concerns over

access to justice.

A condominium owner in Ms. Dyke’s

position finds it difficult enough to deal with a board that is managed

in the way of a large corporation like MTCC No. 972 appears to be. She

would have her access to justice entirely impeded if the costs she has

to bear were as high as those requested here.

I will exercise my discretion to award MTCC No. 972 costs of this

motion of just under one-third of its partial indemnity request. Ms.

Dyke shall pay costs to MTCC No. 972 in the amount of $20,000,

inclusive of HST and disbursements."

top

Ruben

Carriero vs John Carli and Anna Carli

Small Claims Court Brampton

Court file No. SC-11-002106-00

Date: April 8, 2013

This is an extremely interesting judgment by Deputy Judge M. Klein in a

Brampton Small Claim judgment in which he states that the Peel

Condominium Corporation No. 110 was removed as a defendant—on consent

and that he thought that this was a grave error.

It is obvious that the plaintiff would have been successful in getting

the condominium corporation's legal fees reduced. Reduced by how much,

the judge does not say.

The judge does say:

Par 8: It was not until after a

ridiculously high amount of legal fees were expended by all parties,

and after a Superior Court of Justice application at Brampton, brought

by the condominium corporation against the defendants, when judgment

was rendered, on consent, on November 9, 2010, wherein the dog was

ordered to be removed and the defendants were ordered to pay $2,000 in

costs.

Par 9: I was told at trial that the

plaintiff, himself, including the charge-back fees, spent over $23,000

with respect to this matter.

Par 17: The plaintiff ought to have

challenged the solicitors' fees rendered to the condominium

corporation. It was clear when the property manager gave evidence at

trial, that as the lawyers' accounts came in, the accounts were paid

without question and then passed onto the plaintiff, who again, without

question, paid them. I believe that there is an obligation on property

managers to act wisely and prudently in their position of trust, with

respect to paying accounts, whether it be for the plumber, the roofer

and even the lawyers. In my review of the accounts rendered by the

condominium corporation lawyers, I find that they were excessive and

simply out of line. These accounts ought to have been challenged.

Par 22: Justice Nancy Backhouse

ruled:

"Section 134(5) is not an invitation to counsel to aggressively work a

file or unreasonably build up costs..."

Par 24: ...The real

issue is the

extent to which condominium boards can recover their legal costs

against unit owners. There are other cases that surmount to a warning

to condominium managers and their boards that they can’t undertake

litigation so recklessly and/or aggressively, and then expecting the

courts to bless their tactics which attract unreasonable and

disproportionate legal bills.

Plantiff

had responsibilities

Par 27: The plaintiff seeks

indemnification and places the blame squarely on the defendants. He is

right and he ought to be compensated. However, as referred to above,

there has to be some responsibility placed upon the plaintiff to

mitigate in these circumstances. Aside from the fact that he took no

action to remove the defendants from his premises, he never objected to

these "overly aggressive" lawyers' fees. It appears that he did

not seek legal advice until October of 2010. Had he done so

sooner, those fees may very well have been drastically reduced.

Therefore, although I am placing fault on the defendants, I am not

going to place the full brunt of the liability upon them, and am

therefore ordering, indirectly, that the plaintiff share in part of the

"burden."

Par 28: Again, I express my concern

that the condominium corporation was removed as a party to these

proceedings, for as in Bazilinsky, I would not have had any issue with

drastically reducing the condominium's recovery on its legal fees.

Judgment

Par 28: The plaintiff shall have

judgment against the defendants in the amount of $13,000.

Par 29: The plaintiff shall have

costs fixed in the amount of $750.

Lessons for

owners

Please read the entire judgment. It is written in clear language and it

serves notice on irresponsible condo corporations to reign in their law

firms.

It also urges owners to seek legal assistance (from a lawyer

experienced in condo law) as soon as you realize that you are in a

dispute with the condo corporation.

Lesson for

landlords

Renting out your condo units has its risks. How long will it take for

Mr. Carriero to recover the losses the condo corporation's manager and

lawyers and

his tenants gave him?

top

YCC No. 301

v. James

Superior Court of Justice—Ontario

| Before: |

Justice B. P.

O’Marra

|

Court File No: CV-13-487955

Date: 09 June 2014

Costs Endorsement

On 07 February 2014 Justice Morgan had appointed the Office of the

Public Guardian and Trustee as Litigation Guardian for Ms. James. On 14

April 2014 Justice O’Marra ordered that Valerie Victoria James vacate

her unit and that the unit be sold.

YCC No. 301 was now seeking legal fees and other amounts as follows:

| $117,769.65 |

on a partial

indemnity scale; and |

| $125,230.48 |

on a full

indemnity scale. |

The costs submissions for the applicant include the following charges

that are neither legal fees nor disbursements. They are as follows:

| $ 2,828.05 |

Locksmith charges |

| 020,868.84 |

Security charges |

| 001,243.00 |

Plumbing charges |

| 002,886.27 |

Fire inspection and

environmental restoration charges

|

| $27,826.16 |

Total

|

Those items are real costs incurred by the applicant as a consequence

of the respondent’s behaviour but they are not “additional actual cost”

within the meaning of the Act. They also cannot be described as having

been incurred in obtaining the order. The award of costs will not

include those items.

Analysis

The lawyers for the applicant have submitted for 305.8 hours. That

includes 46.1 hours for Mr. Fine (1976 call to the Bar) and 243.4 hours

by Joy Mathews (2012 call to the Bar). Both Mr. Fine and Joy Mathews

attended and billed for motion scheduling dates as well as hearing

dates. The combined court attendance total was 53.3 hours. It was not

necessary or reasonable that both senior and new associate attend for

the various scheduling dates.

I am satisfied that a considerable amount of work was required to

thoroughly prepare the materials filed on behalf of the applicant.

However, the number of hours required, particularly attributed to less

experienced counsel, was excessive.

The applicant’s lawyers have significant experience and expertise in

the area of condominium law. In my view, it is not reasonable expect

that the applicant would pay for the excessive number of hours

submitted for the lawyer who was called to the Bar in 2012. Most of

those hours appear to be dedicated to the training and education of a

young associate.

In my view, the applicant on this record would reasonably expect to pay

the following to their own lawyers: 46 hours for Mr. Fine at his actual

rate and 120 hours for the associate called to the Bar in 2012 at a

partial indemnity rate plus disbursements of $5,277.11.

Result

Costs are payable to the applicant in the amount of $58,000 inclusive

of disbursements and HST.

A

top

MTCC No. 634 v. Adamo

Ontario Superior Court of Justice

Court File No: CV-14-498728

Before: Justice D.L. Corbett

Date: 30 October 2015

Costs Decision

MTCC # 634 is a 31 year old condo tower at 255 Bamburgh Circle in

Scarborough. It brought Mr. Adamo to court to get his fireplace brought

into compliance with fire regulations.

By the time they got to court, he complied with the condo’s request so all that remained was costs.

At the hearing the condo produced a bill of costs showing a claim for

partial indemnity costs of $30,000. During oral argument it moderated

this position to $15,000, plus disbursements and HST.

Justice D.L. Corbett writes:

“I described this claim as appearing to be “exorbitant” given the

nature of this application, which I suggested should ordinarily attract

an order for partial indemnity costs in the range of $3,500 to $5,000.

I directed that the applicant provide me with a docket narrative.

Having reviewed the history of the file, it is now easier to understand

how the costs got higher than one would ordinarily expect for a matter

of this nature.

The underlying issue was not of Mr. Adamo’s making: it affected all

owners of units with fireplaces. The condominium corporation gathered

the necessary information and coordinated a remedial plan for all the

affected owners. No doubt it was unwelcome news for the affected

owners, but it was a maintenance problem that simply had to be fixed.

Mr. Adamo resisted fiercely and took the position that the problem was

caused by the condominium corporation’s failure to perform annual

maintenance, a claim that was never proved. Mr Adamo was clear in his

refusal to remedy the problem, either in the manner proposed by the

applicant, or on his own, and told the condominium corporation that it

would have to obtain a court order if it wanted to compel him to fix

the problem.

In this context, Mr. Adamo has only himself to blame for the fact that

the applicant incurred costs to bring this matter to court. The

applicant took all reasonable steps and showed real patience with Mr.

Adamo prior to commencing litigation.

On the other hand, the applicant’s entitlement to indemnity for costs

is restricted to the costs reasonably necessary for the litigation

itself, and not extra-litigation efforts to identify and rectify the

problem. Those costs must be proportional and consistent with Mr.

Adamo’s reasonable expectations of the costs he might be called upon to

pay: Boucher v. Public Accountants Council for the Province of Ontario

(2004), 2004 CanLII 14579 (ON CA), 71 O.R. (3d) 291 (Ont. C.A.).

Taking everything into account, I am satisfied that a reasonable award

of partial indemnity costs is $9,000, inclusive. As indicated in my

original endorsement, Mr. Adamo shall pay this amount at the rate of

$500 per month, without interest, provided he continues to own his

condominium. If he sells his condominium prior to retiring his costs

obligations, then the balance of the costs order then outstanding shall

be payable immediately.”

This is a very interesting case as the judge cut the condo’s costs down

from $30,000 to $9,000. Furthermore, Mr. Adamo can pay this debt at a

rate of $500 a month without interest. He has 18 months to pay the

condo this costs award which is most likely far lower than what the

law firm charged the condo corporation.

top

Hadani v TSCC No. 2095

Small Claims Court

Court File No: SC-14-00000644-0000

Before: Deputy Judge Samuel S. Marr

Released: 24 August 2016

Ruling on Costs

TSCC # 2095 is a 36 storey 510 unit condo corporation at 628 Fleet St in Toronto in the Fort York district.

The Plaintiff (an owner) lost a Small Claims action in which he sought $16,599.68 in damages.

The Defendant (TSCC #2095) asked to be awarded its costs on a full

indemnity basis. Its legal fees were $30,823.46, plus $2,169.89 in

disbursements.

The amount that TSCC #2095 would get depended on whether the judge

followed the provisions on costs found in Section 29 of the Courts of

Justice Act or the cost provisions of the Condo Act and the condo's

Declaration.

There is a detailed account of the defendant's arguments on why they

should get full costs in the judgment. The judge concluded, in part:

"If the Legislature intended the

ordinary cost Rules of the Small Claims Court not to apply to actions

against Condominium corporations, it would have expressly said so...."

Costs

A cost claim that is almost twice as much as the amount sought by the

Plaintiff in damages is not proportionate and accordingly is not fair

or reasonable. The judge allowed TSCC #2095 15% of the Plaintiff's

claim.

The disbursement claim was found to excessive and unreasonable for a

small claims court action. The judge knocked the $2,169.89 down to

$595.96; 27% of what was claimed.

TSCC #2095 was awarded a total of $3,085.91 ($2,489.95. for fees and $595.96 for disbursements, 9% of what they asked for.

top

Royal Bank of

Canada v. MTCC No. 1226

Court File No. 12-35966

17 October 2012

Justice

Whitten

In

this case, the Royal Bank of Canada, who foreclosed on a condo unit,

was being billed by the condo's law firm for excessive legal bills,

bills that

kept growing. The bank challenged those bills in court and won.

What

is fascinating, is the language that Justice Whitten uses to describe

the condo's law firm's actions.

The following is has been taken from the actual judgment.

The

actual invoices are somewhat rich. Legal fees of $650.00 to prepare and

register the Certificate of Lien is a bit high given that it was

probably, as Gilbert described, "a cookie cutter" service.

The

invoice of April 26, 2010, of $1,150.00 for preparation and issuance of

Notice of Sale does present as excessive. The document is obviously

producible through the relevant software and probably took all of ten

minutes to produce. The same could be said of its issuance.

Similar comments could be

made with respect to the

invoice of April 14,

2010, with respect to the preparation and issuance of the Statement of

Claim. $975.00 for filling

in the blanks in the

software program appears excessive.

The most detail is provided

in the actual invoice of June

24, 2010. A

fee of $3,703.50 is claimed for various activities with no indication

how much time is consumed or by whom for each activity on the dates

enumerated.

In that invoice, one

notes that on May 20, 2010, "consider and confirm status of owner and

strategy accordingly." Similarly, on June 21, 2010, someone met with a

member of the firm B. Chaplick, "conversations were had with a client

(about what?) ... Obtain instructions and discuss potential courses of

action (keep in mind, this was a motion essentially to challenge the

fees of F&D) ... Advise client that owners are known to be

outrageously litigious (obviously someone within

F&D is quite spooked by this challenge to their fees)

...

review numerous motions of owner (there is actually only one at this

time), and instructions to staff." (Who are the

staff—are we talking about the office cleaners, the legal assistants?)

On June 22, 2010, there was

effort directed to the

preparation of a factum and book of authorities. One

wonders, what were the pithy legal issues? The owners wanted an

extension of time to file their pleadings and to challenge the legal

fees.

The clerk cautioned that the

total payout of $14,294.91

was only as

valid as of the date of the email (i.e. June 25, 2010). This caution

became a repeated mantra every time a request was made of F&D as to

a payout figure.

No doubt these gratuitous

remarks would add an element of drama to what normally would be a

mundane commercial matter. In light of the fact that up until this

point the unit holders had really only challenged the calculation of

the legal fees of F&D, these remarks were totally uncalled for. Any litigant, no matter their

deficiencies, is

entitled to challenge legal fees, such a challenge is perfectly

legitimate.

Those services as enumerated

in the various invoices

provided in June

and July, 2010, were not "reasonable" costs in the meaning of s.85.

They were non specific, products

of F&D's

hysteria in dealing with a difficult litigant.

F&D were

not only flogging a

dead horse, they were acting as if it would go around the track.

If F&D pursues collection of

its fees against the condominium corporation, innocent unit holders will be

penalized but not because of the former owners in this matter, but

because of the irresponsible

behaviour on the part of F&D. That is not the equity that

Justices Lane and Doherty spoke of being protected under the statute.

top

Royal Bank of

Canada v. MTCC No. 1226

Court

File No. 12-35966

14 January 2013

Justice

Whitten

Jeffery Kukla, Counsel for the Applicant

Megan L. Mackey, Counsel for the Respondent

Ruling with

respect to costs

[1] By ruling dated September 17, 2012, this court ruled

that the applicant was indeed entitled to a discharge of a lien filed

by the respondent pursuant to s. 85 of the Condominium Act S.O. 1998

c.19. That ruling concluded with the usual invitation for agreement as

to entitlement and the quantum of costs or submissions. The latter have

now been received. Although the court did mention in the ruling the

provisions of rule 57.07, the possible invocation of that rule is not a

factor in the determination at hand.

[2] Section 131(1) of the Courts of Justice Act establishes that

costs are in the discretion of the court. As with any discretion, it is

to be exercised with an eye to principle and fairness.

[3] Rule 57.01 sets out the general principles applicable

to the determination of costs. The pertinent principles in this matter

are: the complexity and importance of the issues and the

efficiency of the litigation step. By “efficiency”, it is meant that

the jurist regards the behavior of the litigants with a view to

determining whether a particular step and response was necessary and

competent. Obviously there is a broad range of litigation steps and

responses from the purely obstructive to the advancement of a genuine

legal or factual issue.

[4] This application was of importance to mortgagees and

condominium unit owners generally in determining what appropriate costs

are to be included in the discharge of a lien filed by a corporation

for unpaid common expenses. The ramifications for the unit owner

is that their equity stands to be diminished; for the mortgagee, there

are fiduciary duties with respect to the funds dispersed. If there are

no parameters as to the appropriate costs to be included, both unit

owner and mortgagee can be at the mercy of the condominium

corporation. This is above and beyond the delay experienced in

obtaining a discharge which, in some cases, would frustrate the

possibility of a transfer of ownership.

[5] The Condominium Act, by its language, sets out a

straightforward mechanism for the discharge of common expense liens.

The ruling of October 17, 2012, described a tortuous and evasive route

to the discharge of the lien in this particular case. More expense was

generated for both sides and was caused by the position taken by

F&D, former counsel for the respondent. The economies to be gained

by an early filing of a notice of discontinuance of the action on

behalf of the corporation and the provision of a discharge of the lien

were obvious.

[6] Former counsel introduced into what would normally be a

straightforward exercise extraneous factual considerations. The

behavior of one of the unit holders in other non-related matters was of

no consequence to a bank seeking to discharge a common expense lien. In

a way, the bank was dragged along by F&D in its characterization of

the original unit owners, incurring more expenses for both bank and the

condominium corporation.

[7] The response of F&D to this simple request for a

discharge was not well thought out. The statutory regime was forgotten.

The response was not a competent response. The details of additional

expenses incurred by F&D were not really “details” at all, but

merely notations of actions taken by various staff and members of a

firm, without a description of the purpose behind the actions. It would

have been difficult for an objective observer to determine what,

exactly, was being done to merit the additional expense.

[8] It would be hard to characterize the conduct in

this response to a request for a discharge as being malevolent or a

function of attrition, such that the substantial indemnity rate should

apply. However, the careless and inept response merits a level of costs

between substantial indemnity and partial indemnity.

[9] The bill of costs submitted by the applicant reveals

acceptable hourly rates and time expended. It is acknowledged that some

time was expended because of the express concern of the court with

respect to “reliance”. This musing by the court ultimately played no

role in the ruling rendered. For that reason, it is appropriate to

“back out” a sum representing the efforts of counsel in that regard, as

it was not directly the result of the actions of either party.

[10] The disbursements of $1,098.75 are acceptable. Given the

comments above as to the appropriate level of costs, the fees payable

to the applicant are fixed at $10,000.00, plus the appropriate HST.

These costs are to be paid forthwith.

[11] As indicated in the correspondence accompanying the cost

submissions, counsel will arrange with the trial coordinator for a time

to consider the implications of rule 57.07. That scheduling, of course,

is premised on the fact that counsel will not be able to resolve

between themselves as to whether there should be a contribution to the

costs found above by the former law firm.

top

Cooper v. 580

Christie Street Co-Op Inc

Ontario Superior Court

Court File No: CV-12-443847

before: Justice Mew

Date released: 11 August 2014

Glenn Cooper was terminated by the co-op in May 2010 and he failed in

winning any of the five issues that he raised in his motion.

Costs

The co-op was seeking seeking partial indemnity costs, if successful,

of $14,312.71.

Mr. Cooper was self-represented and did well on his own behalf.

His submissions were courteous and carefully presented.

The plaintiff’s motion did cause the defendants to amend their defence

so to that extent, Mr. Cooper enjoyed some success.

Furthermore, on the issue of disclosure, the defendants chose to take a

technically correct rather than a pragmatic approach which could have

limited the scope of the motion.

It is appropriate that Mr. Cooper assumes some responsibility for the

costs incurred by the defendants responding to his motion.

However, having regard to the overarching principle of proportionality

and the principle that the court should fix an amount that is fair and

reasonable to the parties against whom costs are awarded rather than an

amount fixed by reference the actual costs incurred by the successful

litigant, I would fix costs of the motion, payable by the plaintiff to

the defendants within 30 days of the release of this endorsement, in

the amount of $3,000.

So the co-op spent over $14,300 defending themselves, won the case and

were awarded only $3,000 in costs.

top

YCC No. 345 v. Qi

Court File No: CV-10-408077

Before: Justice Michael G. Quigley

Date: 08 July 2013

Costs Endorsement

A townhouse complex in Agincourt put a lien on a condo owned by a

Chinese couple.

A minor problem of a NSF cheque for $497.51 in January 2006 by July

2012 became a whopping claim of $33,000 in arrears.

The condo charged the owners $25 a month for being in arrears plus 12%

annual interest. On top of this were the corporation’s legal fees. This

was all provided for in the YCC # 345’s Declaration and Bylaws. The

total sum claimed on the summary judgment motion, including legal fees,

was $46,735.

Unrepresented

On 12 April 2012, the owners went to court unrepresented. Justice

Michael G. Quigley granted the condo judgment for possession of the

defendants’ condominium unit. The judge ordered that YCC #345 was to

have its costs of the motion, but he did not fix those costs at that

time.

The owners then hired a lawyer, Ann Frances Rundle, and then they started doing

far, far better.

What are reasonable legal

costs?

YCC 345’s counsel argued that "reasonable legal costs" in this case

must mean reasonable costs on a solicitor and client scale consistent

with Article II (2) of YCC #345’s Declaration and Article 11, paragraph

7(b) of YCC #345’s Bylaw No. 1.

In other words, the owners must

pay all of the condo’s penalties and legal fees.

Plainly, that paragraph stipulates that, where a condominium owner is

in default with respect to the payment of common expenses for a period

of 15 days or more, the Board may bring legal action on behalf of the

Corporation to enforce collection of those expenses and, in that event,

"there shall be added to any amount found due all costs of such action

including costs as between a solicitor and his own client."

The argument made by counsel for the condo is that by

becoming condominium owners, owners such as these defendants must be

taken to have understood and agreed contractually to pay that level of

costs in the event that they defaulted in the payment of common

elements or other expenses, because that is what is stipulated in

the constating documents and bylaws of the condominium Corporation.

(Wait

a minute! Do you think anyone would buy a condo if they knew

that the board had the power to stiff them with

such huge costs? Not likely.

—editor)

The defence

However, counsel for the defendants is of the view that only

partial-indemnity costs are called for in this circumstance. She stated

that the court's discretion to award costs, which is preserved under s.

131(1) of the Courts of Justice Act, is not superseded by any

condominium declaration, that the Act stipulates that charges made to

owners must be reasonable, and that only proper charges may be made to

unit owners.

The ruling

Justice Quigley ruled that: “Notwithstanding the importance of common

expenses, I do not accept the submissions of counsel for the

Corporation that "whenever the condominium Corporation pays, the unit

owners pay." The unit owners’ obligation is to pay proper common

expenses. If the corporation enters into a contract that is not

authorized by the Act, the declaration or the bylaws, the owner is well

within her rights to refuse to pay…”

Nonetheless, counsel for YCC #345 distinguishes this case and argues

that the decision in Mancuso should only apply to cases where there is

no authorization in the condominium Constitution to apply all costs as

charges to owners. Respectfully, the judge disagreed.

Justice Quigley concluded that this is a case where the scale of costs

applicable on the assessment should be partial indemnity, rather than

substantial indemnity or full recovery, and notwithstanding the

language that may be found in the Declaration of the condominium

Corporation, or its bylaws.

He found that five of the six reasons advanced by counsel for the

defendants supported that conclusion:

1.

|

First, the legal expenses

charged, totalling $35,767.73 as of July 31,

2012 are immensely disproportionate to the arrears of common expenses

claimed by YCC #345 from the defendants and which were allegedly paid

or available to be paid at all material times. The defendants cannot

reasonably have been expected to anticipate that they would be asked to

pay legal costs of this magnitude given the amount of their original

default. |

2.

|

In addition to the substantial

legal costs claimed, YCC #345 has also

been charged interest on arrears at a significant rate of 12% and it

imposes a charge of $25 per month no matter what the state of the

arrears.

(Some

condos charge 24% per annual interest and Fine and Deo LLB has sold

condos bylaw packages calling for 18%.) |

3.

|

Legal fees of $18,503.43 were

incurred before the summary judgment

motion. They almost doubled to $35,767.73 at July 31, 2012 following

the hearing of the motion. The relatively simple collection activity

involved in trying to collect the common expense arrears and other

amounts from these defendants, including the registration of the lien

and preparing letters of demand, calls into question the

reasonability of these amounts or whether they are excessive. |

4.

|

YCC #345 could have taken steps

to reduce the conflict between the

condominium Corporation and the defendants by explaining and/or

apologizing to them initially, when it was claimed that hurtful and

discriminatory language was used, and when counsel for the

defendants claims this was the only request they really made at that

time. |

5.

|

The defendants offered to settle

this matter in 2008, only two years

after the dispute commenced, but four years before the summary judgment

motion was brought. |

For those reasons, the judge found that the appropriate scale of costs

that should be applied for the purposes of an assessment of costs in

this matter, which he ordered, is the partial-indemnity scale.

The judge also stated that the defendants are permitted to pursue an

appeal on the basis that the amounts claimed by YCC #345 were not

reasonable, and thus that summary judgment ought not to have been

granted.

The appeal

He further stated that if that appeal proceeds, it will hopefully

permit some appellate clarification to be provided about how summary

judgment motions judges are to respond in cases such as this where the

conduct of condominium management may be questionable, but where the

seemingly clear language in the Condominium Act and condominium

Declarations and Bylaws appear to permit a condominium corporation,

such as YCC #345, to claim all of the amounts that it did.

He concluded by saying that experience suggests costs issues in such

cases will also continue to raise issues of fairness and the standard

of conduct to be expected of both condominium corporations and their

owners in disputes such as these relating to common elements and common

expenses.

Condo law firm displeased

At least one lawyer who practices condominium law was not pleased with

this decision. Here is what Richard Elia wrote: Fairness for All or Sanctity for the Offender?

top

MTCC No. 943 v. Khan

Court File No: CV-12-9565

Date: 04

June 2013

Justice

D. M. Brown

Two

of the defendants in this action, Mihaela Jurkovic and Mohammad Irfan

Naeem, were both former employees of Channel Property Management, the

property management company for MTCC No. 943. (Mr. Naeem was the property manager.)

When

MTCC No. 943 advised that it wished to discontinue its action against

them, both sought their costs. A settlement was reached with Jurkovic

in which she was paid costs of $6,500.00.

However,

this particular hearing is interesting for two reasons. First, it

describes the procedures that a plaintiff must take to discontinue its

action against a defendant.

More

interesting, is Justice Brown’s questioning of Mr. Naeem’s claimed

legal costs. In the beginning, the defendant’s lawyer claimed about

$9,000 in costs, which appeared reasonable to the judge.

Then,

a week before the hearing of this motion, Naeem’s counsel issued a new

invoice which billed his client $41,505.88 in fees, together with

$160.25 in disbursements. He was looking for $51,700 from the condo

corporation that was then dropped to $35,000.

The condo suggested $6,500, the same as what they paid

Mihaela Jurkovic.

Justice Brown then asks:

"How,

then, does Naeem arrive at a claim of some $51,000 or $35,000? On May

23, 2013, a week before the hearing of this motion, Naeem’s counsel

issued Invoice No. 4266 which billed his client $41,505.88 in fees,

together with $160.25 in disbursements. No evidence was filed to

explain three groups of work which, according to the time and

disbursements ledger, constituted the work included on Invoice No.

4266."

Justice

Brown then gives a detailed reasoning on why he refuses to accept any

of the costs listed in Invoice # 4266. He then goes on to say:

"That

then leaves for consideration the approximately $9,000.00 billed or

docketed for work performed up to the filing of the last pleading. In

the circumstances of this case, where all parties except Mr. Khan were

victims and the plaintiff had a bona fide basis to assert a claim

against Mr. Naeem, any allowance of costs of discontinuance should be

on a partial indemnity scale, or approximately $5,000.00, all in.

Although I am strongly tempted not to award any costs given the

extravagant cost over-reach revealed in the recent docket entries on

counsel’s ledger placed before me, I suspect that such an approach did

not result from any instructions from the client.

Consequently,

I grant the plaintiff leave to discontinue this action against Mr.

Naeem upon the payment to him of costs in the amount of $5,000.00,

all in."

Wow!

It appears that the judge thought that the defense lawyer was trying to

soak the condominium for greatly inflated legal fees and that Mr. Naeem

came close to getting nothing.

top

DSCC # 187 v

James A. Morton

Ontario Superior Court

Divisional Court

File No: 393/12

Date: 13 September 2012

Before: Justices Aston, Aitken, Lederer

E.K. Chan: for

the Applicant

Samuel S. Marr: for Mr. Morton

Introduction

The Appellant, (DSCC #187) appeals the decision of Justice Gilmore

dated 18 May 2012 in which she ordered that the Respondent, James

Morton (“Morton”), pay to the condo corporation $23,000 following which

the lien registered by DSCC #187 against Morton’s condominium unit

would be discharged.

DSCC #187 seeks an order setting aside the order of Justice Gilmore and

referring to a costs assessment officer the issue of the costs to which

DSCC #187 is entitled under s. 134(5) of the Act and, therefore, the

amount of the lien for common expenses which DSCC #187 is entitled to

register against Morton’s unit.

Morton cross-appeals, asking that the order of Justice Gilmore be set

aside and an order made that, upon payment of $10,000, the condo’s lien

against his unit would be discharged.

History of the

proceedings

The Applicant is a condo corporation in Oshawa. Mr. Morton, the owner

of unit #302 has two dogs, both weighing over 20 kg. Earlier in 2012,

he was ordered by Justice Glass to remove his two dogs from the condo

corporation and pay the condo $10,000 in court costs.

On 16 March 2012, the condo corporation notified Morton that

outstanding common expense arrears in regard to his unit amounted to

$73,802.91 – the legal expenses the condo purportedly incurred to

obtain the compliance order from Justice Glass against him.

In adding these costs to Morton’s common expenses, the condo was

relying on s. 134(5) of the Act, which reads:

Addition to Common Expenses

134(5) If a corporation obtains an award of damages or costs in an

order made against an owner or occupier of a unit, the damages or

costs, together with any additional actual costs to the corporation in

obtaining the order, shall be added to the common expenses for the unit

and the corporation may specify a time for payment by the owner of the

unit.

On March 30, 2012, DSCC #187 registered on title to Morton’s unit a

lien in the amount of $73,802.91 pursuant to s. 85 of the Act, which

reads:

Lien upon default

85(1) If an owner defaults in the obligation to contribute to the

common expenses, the corporation has a lien against the owner’s unit

and its appurtenant common interest for the unpaid amount together with

all interest owing and all reasonable legal costs and reasonable

expenses incurred by the corporation in connection with the collection

or attempted collection of the unpaid amount.

Meanwhile, Morton had entered an Agreement of Purchase and Sale in

regard to his condominium unit. As a result of the lien, the sale

fell through.

On 18 May 2012, Morton brought a motion before Justice Gilmore for an

order that the lien in the amount of $73,802.91 be discharged upon

payment of $10,000 – the amount of the costs award made by Justice

Glass. In the alternative, Morton asked the Court to fix a reasonable

and fair sum to be paid by him to DSCC #187 in order to have the lien

discharged.

Justice Gilmore ordered Morton to pay DSCC #187 $29,000 under s. 134(5)

of the Act, inclusive of the $10,000 costs award already made by

Justice Glass. At the same time, she ordered DSCC #187 to pay Morton

costs on the motion in the amount of $6,000. The net result was that,

upon payment of $23,000, the lien was to be discharged.

Appellant’s

submissions

DSCC #187 submits that Justice Gilmore made an error in law in

determining that DSCC #187’s costs (as ordered by Justice Glass) and

“additional actual costs to the corporation in obtaining the order”

totalled $29,000, without explaining how she arrived at that figure.

DSCC #187 relies on the directions of the Court of Appeal in Toronto

Standard Condominium Corp. v. Baghai Development Ltd to the effect

that, in determining additional actual costs under s. 134(5) of the

Act, the court must explain how it calculates the amount arrived at. It

does not suffice for the court to simply pick an amount which it

considers “reasonable” in some broad sense. DSCC #187 seeks an order

referring the matter to an assessment officer, or to Justice Glass, to

determine such costs.

Respondent’s

Submissions

In response to DSCC #187’s appeal, Morton submits that there was some

evidence before Justice Gilmore that allowed her to conclude that DSCC

#187’s legal costs and additional actual costs amounted to $29,000, and

her Reasons, when read as a whole, provide an adequate explanation as

to how she arrived at this figure.

However, Morton’s primary and preferred argument is captured on the

cross-appeal where he submits that DSCC #187 failed to place any

evidence before Justice Gilmore that DSCC #187 actually incurred any

additional costs above the $10,000 cost award and, therefore, the

amount that Morton should have to pay to have DSCC #187’s lien

discharged should only be $10,000.

For the reasons that follow, we accept this submission.

Standard of

Review

On an appeal from the decision of a judge, the standard of review in

regard to a question of law is correctness.

Meaning of

Additional Actual Costs

It is not in dispute that the phrase “additional actual costs to the

corporation in obtaining the order” included in s. 134(5) of the Act

refers to costs actually incurred by the corporation in obtaining the

compliance order over and above any costs that may be awarded in its

favour against the opposing party.

This was made clear by Doherty J.A. in Metropolitan Toronto Condominium

Corp. No. 1385 v. Skyline Executive Properties Inc:

[Section 134(5)] declares that the corporation may recover both “an

award of costs” and “any additional actual costs”. Clearly, the

language of s.134(5) contemplates recovery by the condominium

corporation of costs beyond those that are addressed in a court order

so long as those costs were actually incurred by the condominium

corporation and were incurred in obtaining the compliance order.

Doherty J.A. went on to clarify that “additional actual costs” could

include legal and non-legal costs, whether or not such costs are

assessable between the parties. They can include legal costs included

in a Bill of Costs presented at the time of a costs hearing but not

ultimately allowed by the judge making a costs order between the

parties.

As Doherty J.A. stated:

“Additional legal costs” will refer to those legal costs properly owed

by [the condominium corporation] to its lawyers above and beyond the

amounts awarded for costs by the court or in a court ordered

assessment. Those “additional legal costs” are properly added to

the common expenses of the unit pursuant to s. 134(5) so long as they

were incurred “in obtaining the order”. As actual legal costs refers to

those costs properly claimed by a lawyer against his or her own client,

the principles governing the assessment of legal bills as between a

lawyer and his or her client, should govern any dispute between [the

condominium corporation] and [the unit owner] as to the propriety of

any part of the legal bills relied on by [the condominium corporation]

in support of a claim for “additional legal costs” under s. 134(5) ...

As Doherty J.A. repeatedly stated in Skyline, the additional actual

costs, whether legal or otherwise, must be properly incurred.

Consequently, if an assessment of the legal accounts of a lawyer to its

condominium corporation client would result in a reduction of such

accounts, it is only the reduced amount that can be considered properly

incurred and includable under the category of “additional actual costs”

under s. 134(5) of the Act. This was reinforced in Baghai where

Armstrong J.A. stated:

In remitting the matter back to the application judge, I emphasize that

while s. 134(5) of the Act may entitle [the condominium corporation] to

more than it would get in an ordinary award of costs, the provision for

“additional actual costs” does not automatically lead to whatever

amount is claimed. Section 134(5) does not give counsel licence to

spend the client’s money with impunity.

As I have just explained, there is a difference between the quantum of

costs a losing party is reasonably expected to pay to the successful

party, and the quantum of costs the successful party is reasonably

expected to pay its own lawyer. But reasonableness remains the

touchstone of both analyses.

Consequently, “additional actual costs” in the context of this

litigation includes those costs actually, and properly or reasonably,

incurred by DSCC #187 in obtaining the order from Justice Glass against

Morton, over and above the $10,000 costs award made by Justice Glass.

This is how Justice Gilmore interpreted this phrase and, in this

regard, she made no error of law.

Requirement to

Explain Determination of Additional Actual Costs

In the Court of Appeal decision in Baghai, released after the decision

of Justice Gilmore in this case, Armstrong J.A. emphasized that a court

determining “additional actual costs” under s. 134(5) of the Act must

consider what would be a reasonable amount for the condominium

corporation to pay its own lawyer to obtain the compliance order.

This assessment is based on the principle of quantum meruit. The

court must then explain how it arrived at the right amount. It is not

sufficient for the court to take a broad-brush approach, refer to a

number of factors, and then provide a number – without providing the

underlying calculations.

Justice Gilmore referred to the scant evidence that had been placed

before her. She had the costs outline submitted to Justice Glass on 05

January 2012 showing DSCC #187’s costs being $30,527 on a partial

indemnity basis and $50,878 on a substantial indemnity basis.

She had a costs estimate in the range of $8,000 to $12,000 provided by

DSCC #187 to Morton prior to the commencement of litigation.

Finally, she had the affidavit of DSCC #187’s lawyer to the effect that

$73,802.91 (and not $50,878) was being claimed in the lien because,

subsequent to 05 January 5, 2012, “his office had determined that there

was other legal work which had not – as of 05 January 2012 – been

billed

to the file.”

As Justice Gilmore noted, what DSCC #187 failed to provide to her was

any evidence as to what costs were actually charged to, collected from,

or acknowledged by DSCC #187 as owing to its lawyer.

It would have been easy for DSCC #187 to have provided copies of

invoices received from its lawyer and noted paid, or copies of invoices

regarding disbursements. DSCC #187’s lawyer could have provided dockets

to show the time devoted to obtaining the compliance order and the

amounts charged in regard thereto. Instead, DSCC #187 claimed privilege

in regard to this information.

Clearly, Justice Gilmore was frustrated with the lack of evidence

before her but, at the same time, she was concerned about referring the

matter to an assessment officer to determine “additional actual costs”

on the basis of further and better evidence.

She decided that the case should not drag on. Morton had to be allowed

to sell his condominium unit and DSCC #187 should be paid for legal

fees and actual costs incurred in the matter.

In an effort to work with what she had and to provide a just and timely

resolution, she arrived at the figure of $29,000. Unfortunately, how

she arrived at that particular amount was not explained.

Regrettably, we find that Justice Gilmore erred in law in failing to

provide the underlying calculations that led to the conclusion that

$29,000 was the proper amount to attribute to the costs order of

Justice Glass plus the additional actual costs incurred by DSCC #187 to

obtain the compliance order against Morton.

Appropriate

Order on Appeal

DSCC #187 urges the Court to refer the matter back to Justice Glass or,

alternatively, to an assessment officer to determine “additional actual

costs” pursuant to the guidance provided in Baghai. Morton urges us to

allow the cross-appeal and find that DSCC #187 has not proven any

additional actual costs under s. 134(5)beyond the cost award of $10,000

made by Justice Glass

It must be noted that DSCC #187 was well aware prior to the motion

before Justice Gilmore that the calculation of its “additional actual

costs” was very much in issue. In his Notice of Motion, Morton

specifically asked that the lien of $73,802.91 be discharged upon his

paying $10,000 or, in the alternative, that the court fix a “reasonable

and fair sum” to be paid in order to have the lien discharged.

In his affidavit in support of his motion, Morton raised numerous

questions relating to how the legal fees purportedly incurred by DSCC

#187 to obtain the compliance order could possibly have been so high.

In the Factum filed on behalf of Morton, his lawyer put DSCC #187 on

notice that he would be arguing that DSCC #187 had failed to produce

its lawyer’s dockets and that DSCC #187 had not provided any details

regarding the time purportedly spent on the file. Morton

specifically alleged that the amount sought by DSCC #187 was

unreasonable and unsupported by evidence.

In the face of such direct notice of the issues to be argued before

Justice Gilmore, it was incumbent upon DSCC #187 to provide the

necessary evidence to support its claim as to the costs it had properly

incurred in order to obtain the compliance order. Such evidence should

have been available. No reason has been advanced as to why all relevant

evidence could not have been tendered on the motion, or as to why a

further – costly – reattendance before an assessment officer was, or

is, necessary.

DSCC #187 made a deliberate decision not to tender relevant and

available evidence on the motion before Justice Gilmore as to

additional actual costs under s. 134(5). The only evidence before

Justice Gilmore relating to properly claimed costs under s. 134(5) was

the costs award of $10,000 made by Justice Glass Consequently, any

award made by Justice Gilmore must be limited to this amount.

Disposition and

Costs

The appeal is dismissed. The cross-appeal is allowed. The substantive

portion of the order of Justice Gilmore dated 18 May 2012 is set aside

and, in its stead, an order is granted that the sum owing from Morton

to DSCC #187 under

s.134(5) of the Act is $10,000. The costs

order of Justice Gilmore remains

in effect.

Morton seeks costs on a partial indemnity basis in the amount of

$10,946 in regard to the appeal and cross-appeal, and in regard to

responding to a motion to admit fresh evidence that DSCC #187 served

but did not pursue.

DSCC #187 does not quarrel with the amount being sought by Morton.

Costs are awarded against DSCC #187 in the amount of $10,946 inclusive

of disbursements and HST.

As a result of the costs order, and the earlier costs order of $6,000

against DSCC #187 made by Justice Gilmore, the condo corporation now owes Morton the

net amount of $6,946.

The lien in the sum of $73,802.91 registered by DSCC #187 on March 30,

2012 shall be discharged.

top

PCC No. 452 v. Marek Jaworowski

Superior Court of Justice—Ontario

Court File No: CV-08-704-00

Date: 08 July 2010

Before: Justice Bielby

Counsel: J. Fine & K. Bailey, for the Plaintiff

P. Wojtis, for the Defendant

The plaintiff seeks summary judgment on its claim for possession,

with respect to condominium unit 04, level 2, for Peel Condominium Plan

No. 452. The plaintiff also seeks leave to issue a writ of

possession.

The defendant owns the unit in issue, suite 204, 335 Webb Drive,

Mississauga, Ontario.

Between December 2006 and December 2007, the defendant fell into

arrears with respect to his share of the common expenses. As a result,

the plaintiff filed a lien against the unit.

This action prompted the defendant to bring an action in Small Claims

Court claiming the “wrongful collection of condo fees and the

reimbursement of legal fees, extra costs incurred and to establish the

true balance of common element fees.”

The matter proceeded before Deputy Judge Klein on 18 December 2007. In

his written judgment the deputy judge noted that the plaintiff claimed:

Arrears

|

5,880.00 |

| Interst |

unknown

|

| Legal fees |

$3,520.00 |

The defendant maintained he owed only $5,880.00 (nothing for interest

and legal costs) but acknowledged when the lien was registered in

January 2007 he was in arrears and that the lien was valid.

The Small Claims Court action brought by the defendant was dismissed

and the plaintiff was awarded costs of $500.00. The deputy judge noted

that the defendants (plaintiff in this action) actual costs exceeded

that amount but felt that $500.00 was the maximum he could order.

The plaintiff indicated that at the time it commenced its action the

arrears had risen to $6,532.37 as the defendant missed two payments in

2008 (January & September). That evidence was not challenged and I

found that amount $6,532.37 to be the arrears of June 17, 2010, the

date of the motion.

In the last week or so the defendant has paid the original arrears

amount of $5,880.00 and has paid the $500.00 in costs. No payment was

made on account of interest.

Section 85 of the Condominium Act, 1998, S.O. 1998, c.19 is the

vehicle by which a lien for arrears is authorized. It allows the lien

not only for arrears, but interest on the arrears and reasonable legal

costs incurred in the collection or attempted collection of the debt.

It should also be noted that the plaintiff commenced a Notice of Sale

Proceedings in May 2007. As a result, and since the unit is occupied by

the plaintiff, he brought this action for possession.

The lien is given priority even over prior registered mortgages (s.86

(1)). The sale process is governed by the Mortgages Act.

Interest is claimed at the rate of 18% per annum, as authorized in the

condominium by-laws. The plaintiff submits that the interest owing to

the date of payment is $4,413.19. The number was not challenged by the

defendant.

I also note there is a small portion of the arrears that remain

outstanding, being the difference between $5,880.00 and $6,532.37, and

there is another interest calculation to be made.

I find that at least $4,413.19, on the original amount of $5,880.00 is

owing, with respect to interest.

Costs

|

The real issue

before me relates to costs. As indicated, reasonable costs are

recoverable.

The plaintiff was required to defend the defendant’s Small Claims Court

action. That action related to the issues of the arrears. I find that

the defence of the Small Claims Court actions was part of the

collection process. Accordingly, the reasonable expenses incurred in

the Small Claims Court action are recoverable, over and above the

$500.00 costs award.

Before Deputy Judge Klein, the plaintiff advised the court that the

total debt owed by the defendant included $3,520.00 in legal fees.

|

Less than one month later, by letter dated 09 January 2008, from the

plaintiff’s counsel to the defendant, the total amount owing by the

defendant was fixed at $30,715.86. This amount included costs of

$23,587.51.

At this point in time, the plaintiff alleges the reasonable legal costs

have risen to over $60,000.00. Given the size of the claim, this amount

is disproportionate to the money in issue and the legal steps taken.

Justification

for costs

Two authorities have been brought to my attention. The first is York

Condominium Corporation 482 v. Christiansen, 2003 CarswellOnt 6533. The

learned judge concluded that common expenses “are the lifeblood of the

condominium” and the failure by one to pay his share of the expenses

cause suffering to the other owners. (para 16)

The other authority is Metropolitan Toronto Condominium Corp. No. 1385

v. Skyline Executive Properties Inc., 2005 CarswellOnt 1576, a decision

of the Ontario Court of Appeal.

The Court stated that the philosophy of the Condominium Act was to

shift the financial burden to the wrong doer and away from the innocent

owner. The Court also ruled, at paragraph 45, that the reasonable costs

to be recovered, are between a solicitor and his client and are not

limited to costs awarded in any ligation.

While the Skyline decision considered s.134 and while s.134 references

the collection of “additional actual costs” as opposed to “reasonable

costs”, I think the philosophy is the same, to shift the financial

burden to the wrongdoer.

The Notice of Sale remains outstanding. If the plaintiff were to accept

an offer to purchase, it would be bound to complete the deal. In these

circumstances a judgment for possession would likely issue even if

there is a dispute as to what is owed.

What are

reasonable costs

In considering a motion for summary judgment, I am to determine if

there is a triable issue. There is an issue as to what are the

“reasonable costs”.

Notwithstanding this issue however, the defendant continues in arrears

with respect to common expense charges in the amount of $652.37

interest and of some amount of costs.

Until the property is sold, the defendant still has an opportunity to

correct the default and maintain possession. He cannot do so until the

reasonable costs have been determined either on consent or by the Court.

Time needed

Given these facts I will not grant an order for possession at this

time, and will adjourn the matter, as discussed, as to which counsel

took no real issue with, to provide time to deal with the costs issue.

However I will, as a condition of the adjournment, require the

defendant to pay an amount which he is reasonably liable for.

I order the following:

1.

|

The defendant shall pay, within

30 days of the release of this endorsement, to the plaintiff, the sum

of $4,413.18, being the majority of the outstanding interest.

|

2.

|

The defendant shall, within the

30 day period, pay to the plaintiff, the sum of $10,000.00,

representing a contribution to costs.

|

3.

|

The defendant shall pay, within

the 30 day period, the sum of $652.37 being the balance of the

common element arrears;

|

4.

|

The order as to costs is without

prejudice to either party to argue the quantum issue;

|

5.

|

This motion is adjourned to a

date to be arranged between my office and both counsel to argue the

issue of what are “reasonable costs”; and

|

6.

|

The costs of today are reserved

to the next return date.

|

top

PCC No. 452 v. Marek Jaworowski

Superior Court of Justice—Ontario

Court File No: CV-08-704-00

Date: 20 August 2010

Before: Justice Bielby

Counsel: J. Fine & K. Bailey, for the Plaintiff

P. Wojtis, for the Defendant

Endorsement on Reasonable Costs

Here is the judgment:

The matter was adjourned to 16 August 2010, to argue the issue of legal

fees and expenses and what amount is to be considered “reasonable.”

When the condo corporation commenced its collection steps, the

defendant started a small claims court action seeking, in effect, an

accounting as to the arrears claimed. The action was dismissed

with costs of $500.00 awarded to PCC # 452, the plaintiff in this

action.

In his endorsement, dated 18 December 2007, Deputy Small Claims Court

Judge Klein noted that the outstanding legal fees to that point were

$3,520.

In my earlier endorsement I ruled that the costs of defending the small

claims court action were incurred as part of the collection process and

are therefore recoverable under the lien. As a result, the condo is

entitled to recover from the defendant the reasonable costs and

expenses incurred in the collection steps it initiated as well as those

incurred in the defence of the small claims court action.

There also may be interest owing on $652.37, being the arrears over and

above what had initially been paid by the defendant. I have not been

given this calculation, and will make no order in this regard.

The defendant submits that he wishes to pay off all of what he owes

under the lien but argues the costs claimed by the condo are not

reasonable. So it falls to the court to determine the reasonable

costs and expenses and to provide time to the defendant to redeem, if

he is able to do so, by re-mortgaging.

In considering the issue I keep in mind that the arrears plus interest

amount to no more than $12,000, and that the plaintiff’s costs of

defending the defendant’s action were incurred in small claims court.

Counsel for the plaintiff has filed an amended bill of costs relating

to the lien procedures and the costs argument, claiming fees, inclusive

of taxes in the amount of $51,371.70. To this he added disbursements of

$4,387.24, inclusive of taxes, for a total of $55,758.94.

For successfully defending the small claims court action, counsel for

the condo corporation is claiming fees of $20,951.18, inclusive of

taxes and disbursements of $1,619.04, inclusive of taxes, for a total

of $22,570.22.

The plaintiff argues that the total of these two accounts, being

$78,329.16 are reasonable and are to be added to the amount protected

by the lien. This amount is 6.5 times greater than the claim for

arrears and interest.

I accept that the plaintiff is entitled to the reasonable fees and

expenses that it is required to pay to its own lawyers.

I conclude however that I have discretion to determine what are the

“reasonable” costs incurred in the circumstances.

The case, Simcoe Condominium Corporation No. 27 v. Citifinancial, 2004,

is a decision of Justice DiTomaso of the Ontario Superior Court of

Justice. He had to consider section 85 of the Condominium Act and

exercised a discretion in determining what the reasonable legal

expenses were.

Cimmaster Inc. v Piccione, 2010, is a decision of Justice Gray. I quote

page 4 of his decision,

"The principle of proportionality is important and must be considered

by a judge in fixing costs. I have had occasion to apply the principle

even before the promulgation of the recent Rule amendments that

specifically require it to be considered…In my view, as in Pitney

Bowes, the concept of proportionality appropriately applies where a

successful party has over resourced a case having regard to what is at

stake."

The Pitney Bowes reference was with respect to an earlier decision of

Justice Gray in Pitney Bowes of Canada Ltd v. Noia. This case involved

a two-day trial under the simplified rules in which judgment was

obtained in the amount of $13,400. Counsel for the plaintiff sought

legal fees of $11,806.

Justice Gray allowed a fee of $1,000. At paragraph 7 Justice Gray

states, “In my view, having regard to what was at stake, this

expenditure of lawyers’ hours is entirely disproportionate.”

At paragraph 9, the learned judge refers to the Report of the Civil

Justice Reform Project by The Honourable Coulter A. Osborne, wherein it

is stated, “Proportionality, in the context of civil litigation, simply

reflects that the time and expense devoted to a proceeding ought to be

proportionate to what is at stake.”

Justice Gray, in paragraph 10, stated that in his opinion the principle

of proportionality is encompassed in Rule 57.01(1)(0.b) which requires

the Court to consider the “amount of costs that an unsuccessful party

could reasonable expect to pay.”

I concur with the comments of Justice Gray and note that Rule 57.01

also allows the Court to consider the complexity of the proceedings and

the amount claimed and recovered.

The fees requested by the plaintiff in this matter are far from

reasonable. To say the least, counsel for the plaintiff has over

resourced this case even taking into account the small claims action.

When the matter was before me on August 16th, 2010, two lawyers were in

attendance on behalf of the plaintiff, which was completely

unnecessary. That is just one example of over resourcing. (Note:

The same two lawyers were present at this hearing.)

The case of Mancuso v. York Condominium Corporation, No. 216, 2008 is

authority for the proposition, which I accept, that section 85 of the

Condominium Act allows me a discretion to fix the costs that are

appropriate in the circumstances and that I can take into account Rule

57.01 and the reasonable expectation of the parties.

In the matter before me counsel for the defendant submitted that costs

of $15,000 to $20,000 would be a reasonable amount. With respect to

Rule 57.01(1)(0.b), this representation can be considered the amount of

costs that an unsuccessful party could reasonably expect to pay.

I have also had regard to the plaintiff’s argument that whatever the

defendant doesn’t pay will have to be shared by the other condominium

owners. I agree that this is, on its face, an unfairness.

However there is an unfairness in the amount of fees claimed. The

plaintiff within the lien process is only entitled to reasonable costs

and it is for me to determine that amount.

Within the plaintiff’s supplementary motion record is the bill of costs

for the defence of the small claims court action. I do not intend to

review the account hour by hour but make the following

observation. It is alleged that 35.9 hours were spent preparing

for a trial and for attending on the trial for a full half-day. I find

this to be excessive.

I will allow a fee of $3,000 for the time incurred with respect to the

small claims court, together with the appropriate amount of taxes which

counsel can work out. I will allow the disbursements as claimed in the

amount of $1,619.04, inclusive of taxes.

With respect to the lien matters, a review of the amended bill of costs

reflects excessive hours spent on the file. Again it is not my

intention to review the account hour by hour but can provide, as an

example of over resourcing, at page 8, under the heading, “Bill of

Costs and Further Affidavits,” it is alleged that the hours spent on

this sub issue was almost 35 hours, and involved three lawyers and a

law clerk.

There is absolutely no proportionality to this account. It does not

reflect the complexities of the issues, the amount claimed or the

reasonable expectations of the other party.

More to the point the claim is not reasonable.

With respect to the lien issues, I fix the reasonable fees collectible

under section 85 of the Condominium Act in the amount of $16,000.00,

together with the appropriate taxes. I will allow the disbursements as

claimed in the amount of $4,387.24, inclusive of tax.

In awarding these costs it is my opinion that the amounts allowed are

in the upper range as to what is reasonable.

Once the plaintiff has calculated the HST/GST owing on the fees allowed

and as advised the defendant in writing thereof, the defendant shall

have 14 days to pay balance of the monies owed to the plaintiff.

If the funds are not paid in 14 days the plaintiff can move ex parte on

affidavit evidence as to what has not been paid for an order for

possession.

So a bill of $78,329.16 was reduced to $19,387.24, inclusive of tax.

top

Wexler v. C.C.C. No. 28

Superior Court of Justice—Ontario

Court File No: 16-2191

Before: Justice P. Roger

22 June 2016

Norma Wexler had more luck this time. She asked for a

motion for leave to appeal the costs award to the Divisional Court from

the costs order of Deputy Judge Raymond H. Gouin, of the Small Claims

Court at Ottawa.

Rule 62.02(4) of the Rules of Civil Procedure provides that leave to appeal shall not be granted unless:

(a)

|

there is a conflicting decision by another judge or court in Ontario or

elsewhere on the matter involved in the proposed appeal and it is, in

the opinion of the judge hearing the motion, desirable that leave to

appeal be granted; or |

(b)

|

there appears to the judge hearing the motion good reason to doubt the

correctness of the Order in question and the proposed appeal involves

matters of such importance that, in his or her opinion, leave to appeal

should be granted. |

The owner seeks leave to appeal alleging that Deputy Judge Gouin

erroneously relied on Article X of the Condominium Corporation's

Declaration, despite the findings of this Court in Pearson (Litigation

Guardian of) v. CCC No. 178, contrary to s. 29 of the CJA.

For the reasons set out below, the motion for leave to appeal was granted.

A conflicting decision

Deputy Judge Gouin costs award depended largely on Article X of the

condo's Declaration reasoning that it would be unfair that other unit

owners should bear the costs of this litigation.

Article X makes no mention of legal costs. Here, the Deputy Judge was

dealing with legal costs that seem to have no connection to the common

elements such that his decision conflicts with the decision on this

point in Pearson."

Matters of importance

"I find that the second branch of the test is also made out as it is

desirable to grant leave to appeal as disputes of this nature,

involving condominium corporations are frequently before the Small

Claims Court and the proper interpretation of such provisions and their

potential impact on costs awards, considering s. 29 of the CJA, reaches

that threshold.

Further, I find that there is good reason to doubt the correctness of

the Deputy Judge’s decision and that the appeal raises matters of

general importance, considering s. 29 of the CJA.

The phrase “good reason to doubt the correctness of a decision” does

not require a conclusion that the decision in question was wrong or

even probably wrong. Nor does it require that the judge hearing the

leave motion would have decided it differently had he or she been

presiding as the motion judge. The test is whether the decision is open

to serious debate.

I find that the decision of the Deputy Judge is open to serious debate.

In exercising his discretion over costs, the Deputy Judge seems to have

placed significant emphasis on irrelevant considerations. As indicated

above, he indicates at paragraph 18 that he relies “essentially” on his

finding that it would be unfair considering the condominium

declaration. Section 29 of the CJA provides for an exception which does

not incorporate such considerations. Consequently, there are good

reasons to doubt correctness as the Deputy Judge appears to have

exceeded his jurisdiction.

No submissions have been made on the issue of costs of the leave to

appeal and these are reserved to the Court hearing this appeal."

top

DCC No. 56

v Joanna Stryk

Ontario Superior Court—Newmarket

File No: CV-12-110450-00

Date: 12 April 2012

Madam Justice C. A. Gilmore

Would a condo corporation lien and put an 84 year-old woman’s unit up

for sale? Sure it would and DCC 56 did.

History

When she bought her unit, the defendant, set up a pre-authorized

payment plan for her common expenses. She did not authorize DCC 56 to

take anything but common expenses from her account.

In October 2008, the defendant caused some damage to the condo’s

parking garage door. She did not accept responsibility and refused to

pay the $1,254.75 repair bill.

DCC #56 applied her monthly common expenses payments towards the

charge-back and by allotting her monthly payments to pay the past

shortages in her payments, the 90-day window for applying a lien to her

unit remained fresh.

Then there was a second chargeback for a $220 plumbing bill that the

defendant also refused to pay.

On 30 September

2011, DCC #56 registered a lien against the defendant’s

unit for $1,901.46. This was for $14,75.11 in unpaid common expenses

(actually the back-charges), interest of $15.97 and $419.38 in legal

fees. (So far the legal fees are not too bad.)

On 07 November 2011, a letter was sent to the defendant saying that a

lien was registered and the balance was now $3,810.90. On 19 December

2011, another letter was sent saying that the amount was now $4,689.32.

|

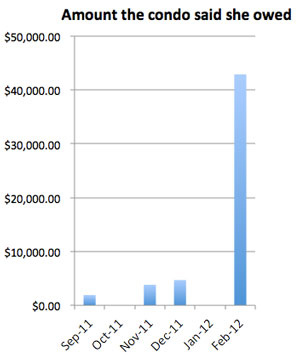

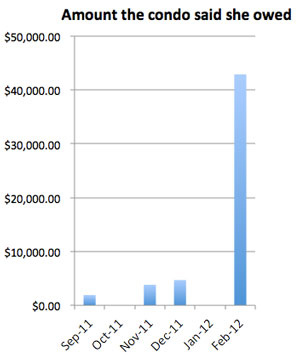

Note the jump between

Dec 11 & Feb 12

|

On 14 February 2012 the lawyer issued a notice of sale and a second

letter on 03 May 2012. On 25 July 2012, DCC #56 commenced an action

against the defendant for vacant possession of her unit. The total

owing that the condo claimed, as of 25 February 2012, was now

$42,894.26.

At some point DCC #56 stopped accepting the defendant’s monthly common

expenses and then charged her interest for the unpaid fees.

Questions for

the judge